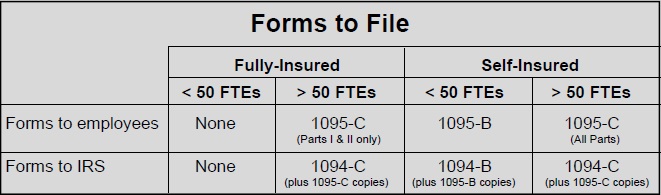

The Affordable Care Act (ACA) reporting forms required to be provided by employers annually include:

The 1095-C form includes information about the health insurance coverage offered to the employees by the employer, and is used by applicable large employers who are fully-insured or self-insured (different parts of the form are completed depending on whether the employer is fully-insured or self-insured). A 1095-C is issued to each applicable employee, and copies of the 1095-C forms are submitted to the Internal Revenue Service, along with the transmittal 1094-C form.

The 1095-B form includes information for employees and dependents who had minimum essential coverage for some or all months during the year, and is typically used by small employers who are self-insured. A 1095-B is issued to each applicable employee, and copies of the 1095-B forms are submitted to the Internal Revenue Service, along with the transmittal 1094-B form.

Refer to the chart below to determine which forms are to be issued to the employees and submitted to the Internal Revenue Service for your organization.

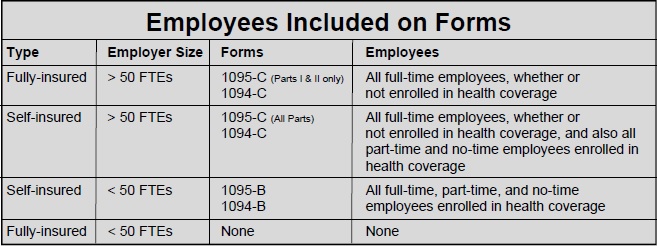

Depending on the specific forms being generated, different groups of employees will be included. For fully-insured large employers, issue a 1095-C form with only Parts I and II completed (and include on 1094-C form) for each employee who was a full-time employee during any month in the year (as based on the measurement period(s) prior to the current year's stability period(s)), regardless if the employee is enrolled in the health coverage or not. For self-insured large employers, issue a 1095-C form with all parts completed (and include on 1094-C form) for each employee who was a full-time employee during any month in the year (regardless if enrolled in the health coverage or not, and based on the measurement period(s) prior to the current year's stability period(s)), and also all part-time and no-time (i.e. retired or COBRA) employees enrolled in the health coverage. For self-insured small employers, issue a 1095-B form (and include on 1094-B form) for each employee enrolled in the health coverage, including full-time, part-time, and no-time (i.e. retired or COBRA) employees. Refer to the diagram below to determine which employees are to be included on the specific forms for your organization.