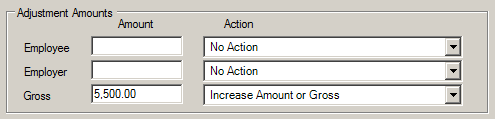

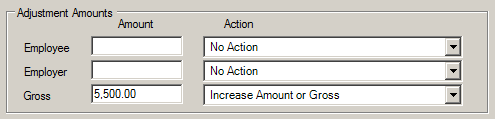

Example 1:

If a new employee was added without the retirement deduction set up on the employee's record and a payroll was calculated for the employee in which retirement was not withheld or expensed, complete the following deduction/tax adjustment for retirement for the employee to adjust the retirement wages by $5,500 (the employee's earnings from the last payroll) in the next payroll:

The above deduction/tax adjustment will add the $5,500 to the next payroll’s retirement gross; the employee and employer contributions will then be calculated on the combined retirement gross.

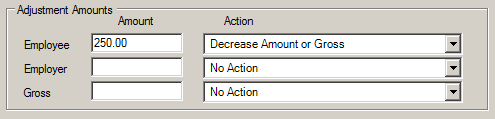

Example 2:

If an employee changed from family health insurance, where the employee's share was $300, to single health insurance, where the employee's share is $50, but the change did not get made for the last payroll so the employee had overpaid $250, complete the following deduction/tax adjustment for health insurance for the employee in order to lower the amount of health insurance the employee pays by $250 in the next payroll:

The deduction/tax adjustment will lower the amount the employee pays for health insurance by $250 ($300 employee share for family less $50 employee share for single), resulting in the employee getting $200 back for health insurance in the next payroll ($250 from the adjustment less the $50 employee share for single health insurance as correctly defined now in the Employee File).

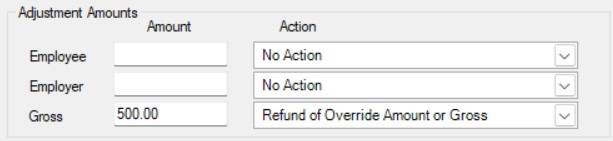

Example 3:

If an employee was added to the retirement plan by mistake (the retirement deduction was set up for the employee but should not have been), complete the following deduction/tax adjustment for retirement (assuming $500 retirement gross):

The above deduction/tax adjustment will pay back the employee and employer contributions (calculated at the applicable rates on the $500 retirement gross) and zero the retirement gross wages for the employee.

Note: The Employee and Employer fields could also have been completed in Example 3 with specific dollar amounts in order to pay back the employee and employer for exact amounts rather than having the system calculate those amounts, if desired.

Example 4:

If a new deduction for an employee that should have been deducted last month was not set up (the employee’s monthly deduction is $50), complete one of the following two deduction/tax adjustments in order to make up the difference in the next payroll:

Option 1:

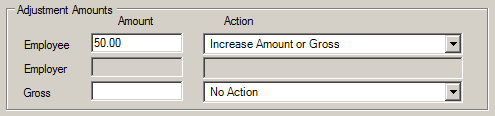

Enter the following deduction/tax adjustment to increase the amount of the employee share for the deduction by $50 in the next payroll:

The deduction/tax adjustment in Option 1 will result in $100 being deducted from the employee’s check for the deduction ($50 from this deduction/tax adjustment plus $50 from the new deduction set up in the Employee File).

Option 2:

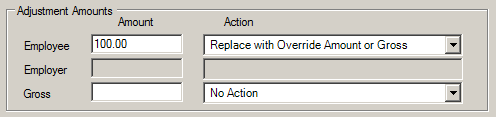

Enter the following deduction/tax adjustment to specify the exact amount the employee will pay for the deduction in the next payroll:

The deduction/tax adjustment in Option 2 will use the specified amount ($100) as the amount the employee pays for the deduction.

Note: In Example 4, the deduction is only paid by the employee so only the fields for Employee and Gross are enabled.

Example 5:

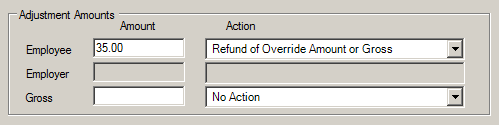

If an employee chose to no longer withhold a deduction (the employee’s monthly deduction was $35) and the deduction should not have been deducted on last month’s payroll, complete the following deduction/tax adjustment for the deduction to pay back the employee in the next payroll:

The above deduction/tax adjustment will refund $35 to the employee for the amount that should not have been withheld from last month’s payroll.

Note: In Example 5, the deduction is only paid by the employee so only the fields for Employee and Gross are enabled.